Beginner guide: Market order, limit order, and stop order

Understanding all basic types of trading orders is one of the top priorities when an investor begins participating in the cryptocurrency market. In this article, Tokenze Xchange will cover the important details and some helpful guidelines about the most common trading order types: market order, limit order and stop order. Let’s see how they are different from each other!

Market order

Among the 3 types of trading orders, a market order is the simplest one.

The market order is an instant order placed at the optimal price available on the market. In a nutshell, it is simply a trading order to sell or buy a cryptocurrency immediately at whatever the current number is. There are sell market orders and buy market orders.

For example, if you place a buy market order via an online cryptocurrency exchange, the price will be executed at the nearest ask price which is the number the seller is willing to sell for. Similarly, a market sell order will be placed at the nearest bid price which is the number the buyer is willing to buy for.

>>>Read more: How to use Market order<<<

Limit order

The next trading order we’d love to explain is limit order.

A limit order is an order that is automatically placed at a predetermined price that traders want to sell or buy. The trading would be successfully executed only if the market hit that price.

Similar to a market order, there are two types of limit orders: Sell limit order and buy limit order.

- For sell limit order, the transaction will be executed at the limit price or higher one

- For buy limit order, the order will be completed at the limit price or lower one

The limit order is highly recommended for cryptocurrency investors who are not actively trading.

For example, you might expect that Bitcoin would fall for $30,000 and decide to put a buy limit order at $30,000. Also, you predict that Bitcoin would recover and rise to $50,000 in a few months, then you could set a sell limit order at $50,000.

Stop orders

While market and limit orders are instant orders, a stop order is an advanced order which is not immediately executed. By setting the stop price and limit price, traders can place a limit on the number that the order will execute. Stop order is a tool for traders to control the risk and the impact of market volatility, minimize losses, protect profits, and initiate new positions.

The stop order involves two prices: the stop price and the limit price.

- The stop price is converted into a sell or buy order.

- The limit price is the maximum price that buyers are willing to buy at and the minimum price that sellers are willing to sell at.

The order would be executed at the limit price only when the stop price is triggered and the liquidity requirement is met.

For example, You put a stop-limit order to sell 1 Bitcoin at $49,900 (limit price) in your order book only if the Bitcoin price hits 50,000 (stop price). By placing a stop-limit order, you could buy Bitcoin before its price drops below $49,900.

If you are a price-sensitive trader, stop order is the trading tool to help you limit the high market volatility and protect your digital assets.

>>>Read more: How to use stop order<<<

How to place your order on Tokenize Xchange

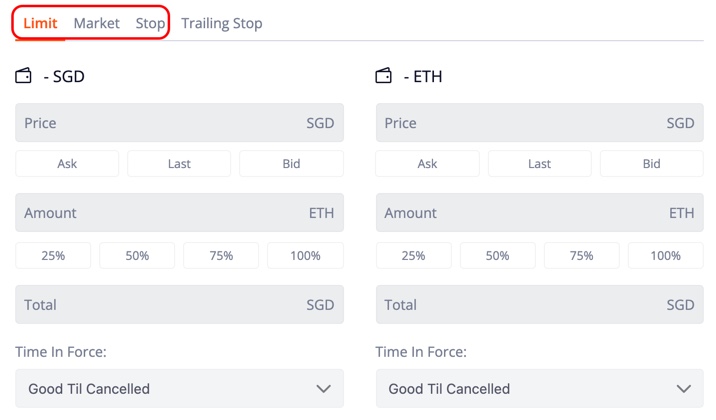

Below is a step-by-step guide on how to trade on Tokenize Xchange using three types of trading orders.

Step 1: Click Trade on your dashboard. Select Spot.

Step 2: Click on the market that you want to sell your asset on the right tab.

For example, if you want to trade SGD-ETH, click on the SGD tab, scroll down the tab and you will see ETH/SGD.

Step 3: Scroll down and select the trading order type that you want to place and fill in.

Keep following Tokenize Blog for more investment guides and market news! See you next week!

Disclaimer

Cryptocurrencies are subjected to high market risk and volatility despite high growth potential. Users are strongly advised to do their research and invest at their own risk.