What to know before buying the dip

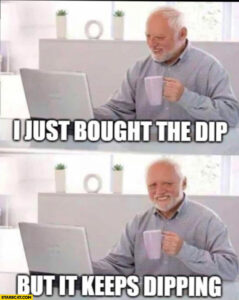

“Take a sip, buy the dip” is one of the most common memes when bringing up fine strategies among stock and crypto investors. The approach of Buy the dip is on the potential for “buy low, sell high” capital appreciation. However, is it a piece of cake? Is there any tip that can help you improve your skill?

In the article: 5 tips to survive Crypto Bear Market, we have indicated that “Buy the dips” is one of the most common strategies after unfavorable news occurs. Dissimilar to chasing the low price to buy, investors use the buy the dip strategy to make money by purchasing at rock bottom and selling when the market rises. To put it another way, it’s a possible way to prevent becoming stuck at a lower price.

By reading this article, you will learn how to buy the dip while also getting some guides to minimize the risk and optimize your opportunity. Let’s find out with Tokenize.

What is Buying the dip strategy?

The simplest financial approach is to “buy the dips” This does not mean you should go all-in when an asset’s price is falling; rather, you should average in as it falls and/or buy after it has settled.

Furthermore, in a bull market or a stagnant market, where the general trend is up or sideways, this method is considerably safer to utilize (as opposed to a bear market where the general trend is down).

To purchase the dips, investors might perform one or more of the following strategies:

- Set lower-priced buy orders and wait for them to fill. This one might be the most common strategy in buying the dips. Buying well before historic support levels and psychological levels is an excellent technique (as prices tend to do at least a quick bounce off these levels). >>>Click HERE to learn about DCA strategy

- Wait for the price to stabilize, and perhaps even show signs of recovery, before buying (buy a reaction off of support)

- As the price falls, buy-in little increments to build an average position, with the goal of buying more as the price falls more.

How to buy the dip in crypto trading?

To discover the proper dip to buy, the Buy the Dip technique necessitates a thorough examination of a cryptocurrency’s support and resistance levels.

The most simple way to purchase the drop is to examine crypto indications more closely; the Exponential Moving Average (EMA) is a good example.

If the current price is above the EMA line, it indicates that the price has remained above previous resistance levels. In reality, now is not the time to buy because prices are expected to plummet in the near future.

In the opposite case, if the price is already below the EMA levels or at previous resistance, it is the greatest moment to buy, with the Buy the Dip technique providing a higher reward.

For example: Look at the chart below. The green arrows indicate all the good times to buy-in or “the dips” which are lying under the EMA levels. It’s often more effective to trade ahead of clear support levels with a stop below the level than to purchase every dip blindly.

With that in mind, and as seen in the chart above, one can “buy the big dips” (or when the price has dropped significantly below the average) or “buy the minor dips” (or buy when the price comes down from wherever it last was).

Although purchasing into strength makes sense, even in a bull market, buying pullbacks is frequently a better strategy than waiting until prices are high (when many other people will be rushing to buy) and therefore exposing yourself to pressure to sell low.

Advantages of this strategy

Using EMA Analysis, Buy the Dip allows you to buy low-priced stocks during a slump and benefit handsomely when the markets resume their upward trend.

Typically, when the market is bullish, it does not join the market. As a result, traders are less likely to get caught in a high-priced situation.

The approach can maximize profit from price differences when the market is rising by following the idea of buying at the lowest feasible price and selling at the highest possible price.

Risks of Buy the dip

For the Buy the Dip method, bad timing is a nightmare. Traders may lose money if they misunderstand the purchasing zone or invest at the incorrect time.

A stop-loss order, which is a type of order that allows you to exit a transaction at a predetermined price, is recommended in practice. If the market goes against you, it can be used to restrict the proportion of loss from the valuation.

True in the sense that we’ve all been guilty of underestimating the strength of some currencies. Some Altcoins’ prices can grow so swiftly from their lowest point that we miss out on the chance to ride the meteoric train to the moon.

Some tips to minimize your risks

When the market is on a downtrend, wise investors should investigate the reasons for the drop.

- Is it possible that the drop was caused by a rumor that will only have a transitory impact?

- Is the cryptocurrency overbought?

- Is it possible that it has just failed to reach an all-time high twice and is now on the verge of a longer-term correction?

If you know the answer, you’ll be able to tell if you should buy the dip. Keep an eye on the news at this point as well. Bad news can exacerbate a downturn, while positive news can result in a speedy comeback (making it hard to get buy orders in if you are waiting for signs of recovery before buying).

While the price is wildly fluctuating, use extreme caution when placing market orders. If the market becomes too disorderly, serious slippage can ensue. This is one of the reasons why, in anticipation of the dip, limit orders were put around supports.

Make as many stops as you need. We all strive to make the best decisions possible, but no one is perfect all of the time. Prepare to take a loss with a stop if necessary. Consider taking some profits if you have any. No one can time every bottom or top perfectly, so take advantage of any opportunities you come across.

Stay tuned and follow Tokenize Blog for more lessons on crypto investment!

Disclaimer

Cryptocurrencies are subjected to high market risk and volatility despite high growth potential. Users are strongly advised to do their research and invest at their own risk.