The Liquidity Feedback Loop: Why Liquidity is Returning to the Bitcoin Market

Written by Reflexivity Research

While Bitcoin and alternative digital assets have offered immense returns for capital allocators over the past decade, one facet of the market that we believe has been underemphasized is the tremendous opportunities for funds that seek to maintain delta neutrality in the Bitcoin derivatives market. While there are a multitude of opportunities on-chain through strategies such as yield farming, lending assets through DeFi protocols, etc., the intent of this report is to provide an overview of the opportunity for yield generation in the Bitcoin futures market specifically, which is the most liquid in crypto. Note that the strategies discussed in this report may also be applicable to other crypto assets.

Throughout the past year, heightened counter-party and regulatory risk has triggered a pullback in activity from major market making firms such as Jane Street and Jump. This, general crypto market decline, alongside with the decline of yields throughout the market, has led to a decrease in the state of liquidity in the crypto market overall, which is shown in the (slightly outdated) chart below from Kaiko Data; which illustrates the 2% bid/ask depth for BTC USD/USDT trading pairs (in BTC denominated terms) on a continuous decline after the FTX collapse.

However, the pullback of these firms sparks opportunities for those that remain involved and well capitalized in this market; as there are now fewer large players to capture market inefficiencies which should bring back many of the dislocations we saw in the previous bull run.

Futures Basis Trade

One of the largest opportunities for delta neutral funds looking to profit from the Bitcoin market is the “cash and carry” trade. Well known in traditional finance, this is done by purchasing the underlying spot Bitcoin and shorting a Bitcoin futures contract that is trading higher than the current spot price. By doing so, you are locking in the difference/spread between the current spot price and the futures contract price, and thus the trade can be perceived as relatively “risk free”, however there are a few small risks to be aware of:

- The first is counterparty risk; which shouldn’t be ignored in crypto (especially after FTX) but is minimized during raging bull markets.

- The second is basis risk. While being long spot and short futures maintains delta neutrality, allocators must be sure that they are capitalized enough to add collateral to the short leg of the trade should the futures basis move higher. Conversely to counterparty risk, this risk actually increases during raging bull markets.

- As a long term investor, the third “risk” to consider is opportunity cost. By shorting the futures contract in equivalent size to your underlying spot position, you miss out on any further potential upside in Bitcoin’s spot price; but most entities (and the ones we are speaking to in this report) putting on this trade are non-directional in nature.

Typically, Bitcoin trades in contango, meaning that the futures curve is positive sloping the further out that you go on the curve; thus there is typically some small degree of yield to be generated from the cash and carry trade in BTC. Here is a look at the current futures curve for Bitcoin across Binance, Deribit, and OKX:

.png)

However, during periods of speculative crypto mania when there is a large degree of demand to be long crypto, we can see the futures basis (difference between spot price and futures contracts) reach insane levels. In the chart below from Glassnode, we can see the historical annualized 3 month futures basis for Bitcoin. During Q1 2021 during peak crypto speculative mania this blew out to over 40% annualized. Following this mania, we saw the basis normalize down to ~3% per annum during Bitcoin’s draw down during the summer of 2021 and ultimately back to over 15% per annum during Bitcoin’s second move up towards $70,000 in Q4 2021.

While the peak 40% annualized yield is a large headline number, just how much size could you get into the Bitcoin cash and carry trade during early 2021? Let’s try to quantify this by doing the following:

- First we will look at total futures open interest and volume figures for Bitcoin throughout the last few years.

- Next we will look at the maximum notional size and yield that was possible to generate from this trade during the last bull market excluding perp open interest.

- Next we will look at the maximum notional size and yield that was possible to generate from this trade during the last bull market excluding perp open interest and CME open interest. (solely crypto native exchanges’ dated futures contracts)

- After that, we will look at the maximum notional size and yield that was possible to generate from this trade on CME only.

- Lastly, we will highlight what the state of the futures basis looks like today, developments in the futures market, the opportunity today, and how we expect it to develop moving forward.

At its peak in February of 2021 Bitcoin total futures open interest, which represents the total amount of contracts that are open (with there being a long for every short), sat at roughly $25 billion dollars across all futures products, including perpetual swaps, on all major venues; and up to roughly $100 billion in daily trading volume on these same products.

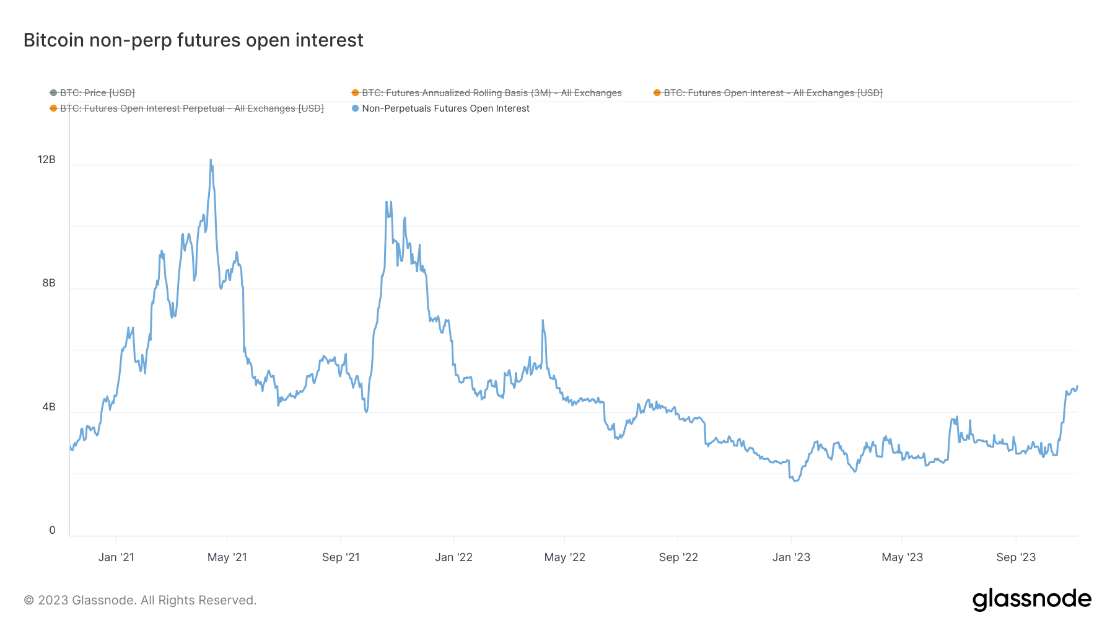

Subtracting out perpetual futures, which we will discuss in the second section of this report, leaves us with Bitcoin open interest reaching roughly $12 billion and daily trading volumes of roughly $25 billion during the peak crypto mania of 2021.

Let’s use this data to try and get a rough calculation of what the notional size of the basis harvesting opportunity was during Q1 2021. We will first calculate the total maximum theoretical position sizing a fund(s) could take as well as the maximum theoretical yield that could have been generated by this maximum theoretical position.

Important Note: These figures will be an overestimation of what is actually possible/feasible as it would be impossible to be short half of the entire futures open interest with some market participants being naked short or hedging for various reasons. These figures also do not account for slippage, which describes the price impact of entering a position on the open market.

Calculating the notional value of the short side of Bitcoin futures open interest is quite simple. This can be done by dividing non-perpetual futures open interest by 2 (given there is a long for every short). Keep in mind, one would also need to simultaneously be long an equivalent amount of underlying spot BTC to maintain delta neutrality.

We can then take this value and multiply it by the 3-month futures basis, and then divide that new value by 4 (given the basis is annualizing the yield of a 3 month futures contract). The formula looks like this:

((Total Bitcoin Futures Open interest – Bitcoin Perpetual Futures Open Interest) / 2) * (3-Month Futures Basis / 4)

This formula gives us the chart below, which is the maximum harvestable yield for putting on a cash/carry trade through Bitcoin 3-month futures. This means that the upper bounds of maximum possible yield generation from the Bitcoin cash/carry trade during peak 2021 was roughly $700 million over a 3-month span. Keep in mind this is only BTC, ETH’s 3-month basis was even higher than Bitcoin’s during Q1 2021, albeit open interest was slightly less.

However, this also doesn’t account for the fact that CME futures offer various contract durations in addition to quarterlies that crypto native exchanges offer. By subtracting CME futures, we can see the total maximum notional position size that could be put on for cash & carry trades through dated futures contracts on crypto native exchanges:

With this maximum position size, we can then calculate the rough maximum harvestable yield on futures contracts outside of CME. The formula for this is as follows:

((Total Bitcoin Futures Open interest – (Bitcoin Perpetual Futures Open Interest + CME Futures Open Interest)) / 2) * (3-Month Futures Basis / 4)

During the peak of 2021 this breached $500 million.

After looking at crypto native exchanges, let’s take a look at CME only. This is becoming increasingly important as CME is making up a larger portion of the Bitcoin futures market, likely because the makeup of market participants trading crypto is shifting towards more “tradfi” hedge funds and quant funds. Not only did the BTC denominated value of CME futures open interest just breach 100,000 BTC for the first time, but the USD denominated value of CME futures open interest as a percentage of overall Bitcoin open interest just set a fresh high of 27%, and doesn’t show any signs of slowing down.

In fact, the percentage of Bitcoin futures open interest made up by CME just flipped Binance for the first time ever.

With that in mind, let’s do our same calculation looking just at CME. We can see that the total notional position size that one could put on through CME was over $2.6 billion in late 2021.

It is difficult to calculate exactly what the rough notional harvestable yield was on CME given they have more dated contracts than crypto native exchanges, but using the same average 3 month basis that we used in our other calculations, this very rough figure peaked out just over $100 million in the spring and winter of 2021.

Before moving onto what this opportunity looks like today and why we expect it to grow, the key takeaway of this section is the following: The notional size and harvestable yield from the cash and carry trade in the Bitcoin futures market were well in the 9 figure range throughout 2021, with the only risk being counterparty risk.

What does this opportunity look like today and why do we expect it to grow?

If you are reading this you likely don’t care about describing what happened in the past, you care about how you can make money in the present. Let’s take a look at this opportunity today. At the moment the current basis sits at just over 10% on Binance and OKX and just shy of 13% Deribit.

On the CME, the 2nd month annualized basis currently sits at just shy of 13% annualized.

These current yields are still far from what they reached during the peak speculative mania of 2021 and we expect them to increase from here. Why?

Historically as Bitcoin’s price has increased, its futures basis has widened. As we’ve learned over the past decade, Bitcoin is hyper cyclical and as an emerging technology, goes through periods of extreme euphoria and depression. We strongly believe that Bitcoin will experience another speculative mania in the coming years and with that, demand to be long Bitcoin/crypto will rise. As long as demand to be long crypto outpaces the ability for funds to arbitrage the spot/futures spread, the basis will grow; and with several market making firms from the likes of Jane Street and Jump pulling back their operations due to decreasing yields, regulatory concerns, and counterparty risk, there are fewer funds market making and arbitraging the spot/futures spread currently than there were over the previous few years.

It is worth noting that the counter-argument to this thesis is that with the rise of CME’s futures dominance, there is now less friction for funds to enter the market and capture the basis; therefore the rate of arbitrage will keep up with the rate of demand to be long crypto.

Another very important development regarding Bitcoin’s futures basis lies in its comparison to the yield possible to generate through owning 3-month US treasury bills. As shown in the chart below, when we compare the spread between the two, we can see that this has just flipped positive, reaching over 2% for the first time in over 1.5 years. This puts a “risk premium” on Bitcoin’s “risk-free yield” for the first time in over 16 months. With the Fed having paused twice in a row and peak monetary tightening likely behind us, we expect this spread between Bitcoin’s futures basis and the US 3 month treasury yield will only continue to grow, which will make the basis trade even more attractive.

Implications for the Market

The dynamics laid out above are not only good for arbitrage funds, but are also good for the market overall. The more actors that step in to close the basis by longing spot and shorting futures, the more liquidity comes into the market. This is great for the Bitcoin/crypto market. By making the Bitcoin/crypto market more liquid and less susceptible to volatility, it opens up the gates for new actors to enter the market that couldn’t before. This is also positive because funds that capture the basis yield will presumably roll some of this profit back into putting on the trade and/or similar trades on/off-chain to capture even more yield. You can think of this as a positively reflexive liquidity feedback loop; and we think it’s just getting started.

Conclusion

To conclude, the opportunity to harvest yield through being long spot and short futures in Bitcoin was a several hundred million dollar opportunity throughout 2021; and with Bitcoin’s futures basis just reaching a premium over US 3 month treasuries for the first time in 1.5 years, many funds/counterparties having left the space throughout 2022, and under the presumption that Bitcoin/crypto will trade higher over the coming few years, as long as the rate of demand to be long crypto outpaces the rate of new entrants capturing the futures basis, we expect that this opportunity will become increasingly attractive in the medium term. This report has also excluded yield that is extractable through positive funding rates in the perpetual futures market; which is structurally similar (long spot short the perp futures contract) and we may write an additional report on in the future. Although some funds may have taken significant hits throughout the crypto bear market, if the yields are there we believe the money will find a way in to extract them.

Overall, this will have positive impacts for liquidity in Bitcoin/crypto markets, and with the wealth effect from yield generated that may be redeployed into the crypto market (thus increasing liquidity further), will ultimately add fuel to any bull market that we may see.

———————————————————————————————————————————————————————————————————————————————————–

This report was authored by Reflexivity Research’s Co-Founder Will Clemente.

For more articles, please visit https://www.reflexivityresearch.com/#reports

Acknowledgements:

Special thanks to Goldentree’s Head of Digital Assets Trading, Avi Felman, and Ikigai Fund’s Founder/Chief Investment Officer, Travis Kling, for peer reviewing. These individuals are not responsible for the information within this research report.

Special thanks to our data partners at Glassnode, Velo Data, and Kaiko Data.

Thanks to Matt Paul Catalano for the thumbnail image.

Disclaimer: This research report is exactly that — a research report. It is not intended to serve as financial advice, nor should you blindly assume that any of the information is accurate without confirming through your own research. Bitcoin, cryptocurrencies, and other digital assets are incredibly risky and nothing in this report should be considered an endorsement to buy or sell any asset. Never invest more than you are willing to lose and understand the risk that you are taking. Do your own research. All information in this report is for educational purposes only and should not be the basis for any investment decisions that you make.

Disclaimer

Cryptocurrencies are subjected to high market risk and volatility despite high growth potential. Users are strongly advised to do their research and invest at their own risk.