The Newsletter by Tokenize Xchange (Vol.150| Aug 2021)

Webinar ‘How to Play & Earn with Axie Infinity’

Axie Infinity is a digital pet universe where players battle, raise, and trade fantasy creatures called Axies. Axie has a fully player-owned economy allowing players to seamlessly sell and trade their game assets for digital currency.

Learn more about Axie Infinity through the actual gameplay in this Tokenize Xchange exclusive game-streaming webinar with our host Alson Chia: CLICK HERE

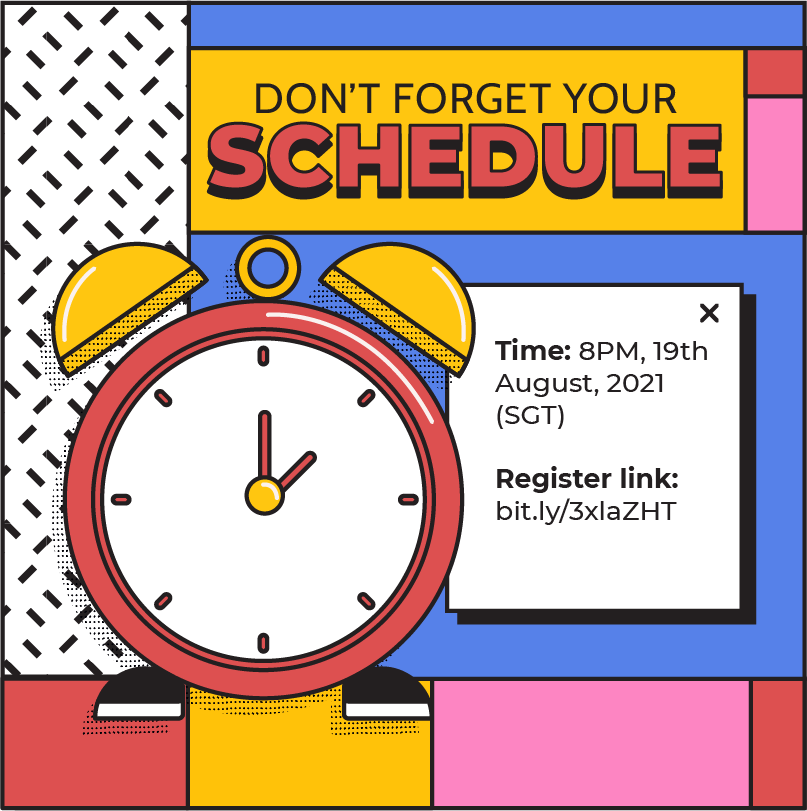

Time: 8PM, 19th August, 2021 (SGT)

What to expect from the webinar?

✔️ Earn up to 120 TKX (worth S$720) by referring Tokenize Xchange to new users and attending this webinar!

✔️ AXS lucky draw at the end of the webinar

✔️ A mystery guest will be joining us for the gameplay portion!

** Terms & Conditions of AXS Webinar Give-away.

Current Top Rankings for Our Aftershock & TKX Give-away

It’s still not over yet. Take part in the race now to grab a chance to win an amazing prize: 𝐀𝐟𝐭𝐞𝐫𝐬𝐡𝐨𝐜𝐤 𝐋𝐚𝐩𝐭𝐨𝐩 (𝐰𝐨𝐫𝐭𝐡 $𝟏,𝟔𝟗𝟓)𝐅𝐨𝐫𝐠𝐞 𝟏𝟓𝐒 | 𝐑𝐓𝐗 𝟑𝟎𝟓𝟎 + 𝐢𝟓 𝟏𝟏𝟒𝟎𝟎𝐇 and free TKX for all participants!

How to participate?

Step 1: Join our telegram channel — https://t.me/tkxannoucement

Step 2: Invite your friends to our Telegram by sending our Invitation Link to them (Optional, for determining the winner of Aftershock Laptop)

Step 3: Fill up the Google form — https://forms.gle/QxxHj7Xa5TV5Z9ah9

- ** Note: The Aftershock Forge 15S Give-away is available for SG residence only, international users can still apply for free TKX.

Prizes

Referrer with the most numbers of referrals (SG residence only):

𝟏 𝐱 𝐀𝐟𝐭𝐞𝐫𝐬𝐡𝐨𝐜𝐤 𝐋𝐚𝐩𝐭𝐨𝐩 (𝐰𝐨𝐫𝐭𝐡 $𝟏,𝟔𝟗𝟓)𝐅𝐨𝐫𝐠𝐞 𝟏𝟓𝐒 | 𝐑𝐓𝐗 𝟑𝟎𝟓𝟎 + 𝐢𝟓 𝟏𝟏𝟒𝟎𝟎𝐇

For every user who joins our Telegram Announcement channel:

𝟏 𝐓𝐊𝐗 (𝐰𝐨𝐫𝐭𝐡 𝐚𝐩𝐩𝐫𝐨𝐱. $𝟔)

General Rules

1. Aftershock Laptop rewards are only available for those users residing in Singapore.

2. The Aftershock Laptop is given to the referrer with the most number of referrals (Top 3 referrers will be updated Weekly in our Telegram Announcement channel)

3. 1 TKX reward available for users who have KYC-ed, joins the telegram group and submits the form

4. Promotion period runs for the month of August — 1st August to 31st August

5. Mulitple submissions will not be allowed (checks will be done against telegram handles)

Stablecoins Support Changes On Tokenize Xchange from 20 August 2021

From 20th August 2021, due to developments in cryptocurrencies and Stablecoins regulations, Tokenize Xchange will delist the following trading pairs on our website:

- SGD-USDT

- SGD-USDC

- SGD-DAI

- USD-USDT

- USD-USDC

- USD-DAI

The current orders for the mentioned Stablecoins will be canceled and the funds will be returned to the users’ digital wallets respectively on 20th August 2021.

For that reason, we announce some updates on Stablecoin support from 20th August 2021 to provide Tokenize Xchange’s users with better experiences.

>>>Check out Stablecoin support FAQs <<<

1. USD Stablecoin deposits can be converted and credited as USD

The USD Stablecoins deposited or sent to your Tokenize USD Wallet can be converted and credited as fiat USD at real-time market rates.

2. Users can receive fiat USD after successfully depositing Stablecoins

After receiving or depositing Stablecoins to their Tokenize Wallet, users can choose to deposit as Stablecoin in Stablecoin wallet or deposit as fiat USD in the USD wallet.

3. Users can withdraw their USD from Tokenize in the form of a USD Stablecoin

Users can make USD withdrawals in the form of a USD Stablecoin by choosing “Withdraw via Stablecoin” and transferring them to an external Stablecoin wallet. Tokenize Xchange will convert your Stablecoins at market rates.

4. Receive your Stablecoin amount after successfully sending or withdrawing Stablecoin

Users will receive the amount of Stablecoins in their external wallet after successfully completing their Stablecoin withdrawal. Tokenize Xchange Support will send you an email to confirm that the transaction is successful.

5. Crypto earn is still available for USDT, USDC, and DAI

The Crypto Earn Program is not impacted by the upcoming changes of Stablecoins. In detail, the Crypto Earn is still available for USDT, USDC, and DAI.

*Please take note that the deposit and withdrawal functions will still be active for the mentioned stablecoins (USDT, USDC, DAI).

Over $600 Millions was Stolen from Poly Network; Hackers Returned Almost All of the Funds

On 10th August, a group of hackers stole over $611 million from Poly Network in the biggest cyber attack in DeFi history! Things became strange after hackers returned almost all the assets after a few days. What happened to Poly Network? Let’s find out with Tokenize Blog!

What is Poly Network?

Poly Network interoperability protocol alliance connecting blockchain networks such as Bitcoin, Ethereum, Neo, Ontology, Elrond, Ziliqa, Binance Smart Chain, Switcheo, and Huobi ECO Chain.

Those blockchains are independent networks with different systems and methods in the way they validate transactions and store data. Moreover, one chain may have a completely incompatible transaction format with another one. As such, it would be challenging for users to move assets among different blockchains.

As a result, Poly Network was born to deal with this issue by developing an interoperability layer to connect blockchains together in a decentralized system. One significant application of Poly Network is to transfer digital assets among blockchains.

So, what happened to Poly Network?

DEX Aggregator 1inch Expands to Ethereum Scaling Solution Optimism

Quick Take

- DEX aggregator 1inch has expanded to Ethereum scaling solution Optimism.

- The aim is to lower gas fees and increase transactions per second for 1inch users.

1inch, a decentralized exchange (DEX) aggregator that sources liquidity from various exchanges, has expanded to Optimism Ethereum, a Layer-2 scaling solution.

The aim is to lower gas fees and increase throughput or transactions per second (TPS) for users, said 1inch. Specifically, Optimism Ethereum will be capable of up to around 2,000 TPS when an optimized production version of its network is launched, 1inch co-founder Anton Bukov told The Block.

However, Optimistic Ethereum’s throughput is currently limited to 0.6 TPS; the limitation is to avoid potential risks and failures during the alpha stage of development, said Bukov. Ethereum’s current TPS, on the other hand, is around 15.

Last month, the decentralized exchange protocol Uniswap also expanded to Optimism Ethereum.

As for reduced gas fees on the Optimistic Ethereum network, Bukov said there should be savings of around 2x-10x compared to Ethereum. “The reduced gas fees became possible due to the architecture of the Optimistic network, which only needs to transfer compressed state changes to Layer-1 (L1) and doesn’t have to pay for calculations on L1,” said Bukov.

1inch users can now start migrating assets to the Optimistic Ethereum network through the Optimism Gateway, said 1inch. The network is compatible with several wallets, including MetaMask.

With the expansion on Optimistic Ethereum, 1inch is now available on a total of four blockchains, including Ethereum, Binance Smart Chain, and Polygon (formerly Matic Network).

Bukov said 1inch is looking to support more blockchains, including Solana, Avalanche, TRON, NEAR, xDAI, and also other Layer-2 solutions like Arbitrum and zkSync.

Aave to Launch Institutional DeFi Platform Aave Arc Within Weeks

DeFi lending platform Aave has rebranded its upcoming institutional DeFi platform from Aave Pro to Aave Arc, according to CEO Stani Kulechov.

The decision was made to represent its purpose as a gateway to bring institutions into the decentralized finance industry. And while the platform is likely to miss its initial estimated launch of July, the final date won’t be far away. “We’re talking about weeks from now,” Kulechov told The Block.

DeFi protocol Aave works by letting token holders deposit funds into liquidity pools. Other crypto users can borrow tokens from these pools (having put up collateral) and will pay the tokens back, with interest. This generates a yield for those who lend out tokens.

Aave Arc’s goal is to provide institutional investors who face stringent regulatory requirements with access to such DeFi protocols in a limited capacity. Arc will offer private pools of funds where only participants who pass know-your-customer procedures can enter, on both the lending and borrowing sides.

In terms of yields, the private pools may end up with different yields to the public pools, since participation is restricted. Kulechov argued, however, that participants with access to both the private and public pools could arbitrage the difference. This could help to ensure the private pools maintain similarly high interest rates.

“I think the larger vision of the Aave Arc market is to create a more comfortable risk appetite for institutions to participate in decentralized finance before, for example, having the risk appetite to participate towards the permissionless decentralized finance, which is the bigger vision offering,” said Kulechov.

Disclaimer

Cryptocurrencies are subjected to high market risk and volatility despite high growth potential. Users are strongly advised to do their research and invest at their own risk.